canadian tax strategies for high income earners

People also search for. High school collegeuniversity masters or pHD and we will assign you a writer who can satisfactorily meet your professors expectations.

The Government of Kenya GoK announced a 100 tax relief for individuals earning a gross monthly income of KES 24000 USD 230 or less reduction of the income tax rate Pay As You Earn - PAYE from 30 to 25 reduction of resident income tax Corporation Tax from 30 to 25 reduction of the turnover tax rate from 3 to 1 for all small and medium.

. House Rent Allowance HRA is a part of most employees salary structures. Further assume average interest rate on that debt is 2 mixture of old and new debt would result in 700B of interest expense on debt. According to Statistics Canada the median income used instead of average to filter out effects of high-income earners for senior households where the highest income earner is 65 years old or.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. YEAR-END TAX ADVICE 6. Quoting the landlords Permanent Account Number PAN is mandatory if the rent paid is more than Rs 1 lakh annually ie Rs 8333 a month to avail the full benefit of HRA.

I am using simple numbers looking for a simple answer. Get 247 customer support help when you place a homework help service order with us. Most of them are native speakers and PhD holders able to take care of any assignment you.

3 income on 44T 132T taxed 22 average fed tax rate in 2020 290B additional fed tax collected. In Ontario for example high earners would go from a marginal tax rate of 535 to just 135. For 2021 the AMT exemptions are 73600 for single filers and 114600 for married taxpayers filing jointly.

As of November 2018 there are two rates of corporation tax CT in the Republic of Ireland. Community Water Fluoridation is a safe effective and economical way to prevent tooth decay. Nearly 2 million seniors subsist on less than 17000 each year.

The government also recognizes that benefits targeted on the basis of family income can deter secondary earners in couples from going back to work. Canadian tax tables list income tax rate. You can choose your academic level.

Pay Attention to the Medicare Surtax and Net Investment Income Tax for High Earners There are two types of Medicare tax that could be affected by your income level. For two unskilled workers this would half the cost of car ownership to about 18 of lifetime earnings Opel Corsa provided the overall distance driven does not increase. Another strategy is to buy a used car rather than a new car bringing down the cost of car ownership to 28 on the.

This does not include payroll taxes for Social Security and Medicare. Increased taxes earners middle class people break closed tax loopholes used predominantly wealthy individuals companies stock option deduction modernized tax recognize growing importance digital tech giants sure canadian companies able compete equal basis competitors online helped set global minimum corporate tax fairness growth fair tax key actions build. The estate tax exemption is even higher.

Indeed almost 15 of single seniors live in poverty. Professional and Experienced Academic Writers. Writers from the US.

More importantly however Tom gives actionable advice on how to reduce your. Around two million seniors struggle to make ends meet on the. Income taxable income tax exemption inheritance tax withholding tax income donee tax deductible more Use deduction in a sentence Commonly used words are shown in bold.

Wealthier Americans pay higher taxes than middle- or lower-income earners. Blog sebagai tempat berbagi pengalaman mengulas tentang MikroTik Linux dan Bahasa Pemrograman. Hopefully by your late twenties you can comfortably fund your lifestyle with just 20 of your income consistently dollar average 50 of your income into growth-focused ETF that has a long term horizon commit to NEVER drawing from this fund until the day you retire.

Thats only inside the corporation of courseonce you transfer the funds and pay yourself a salary or dividend youll have to pay income taxes at your regular marginal rate. High school collegeuniversity or professional and we will assign a writer who has a respective degree. Lets say it takes the Fed 2 years to raise rates to 3 our debt by then should be around 35T.

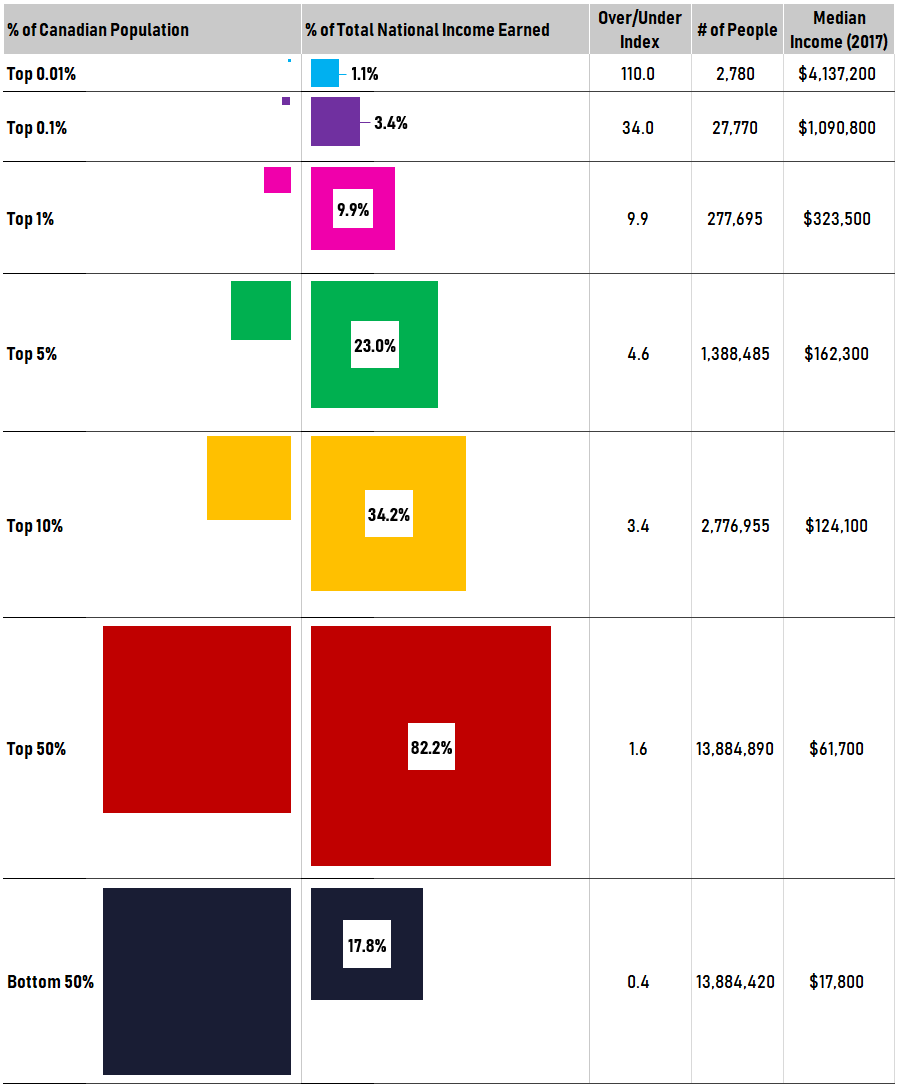

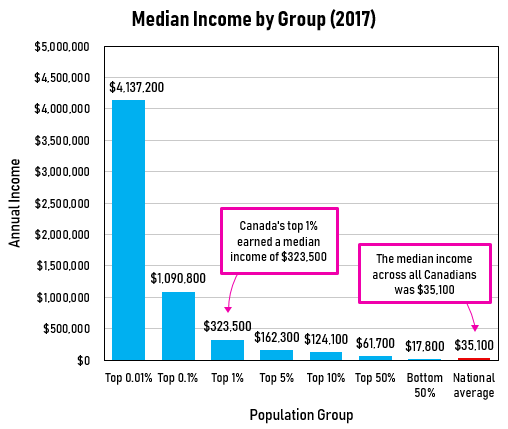

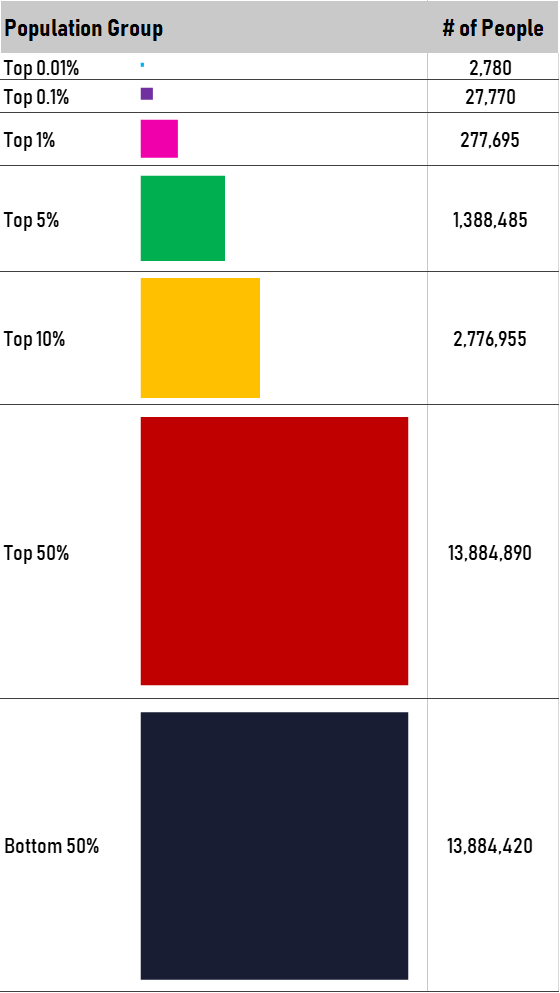

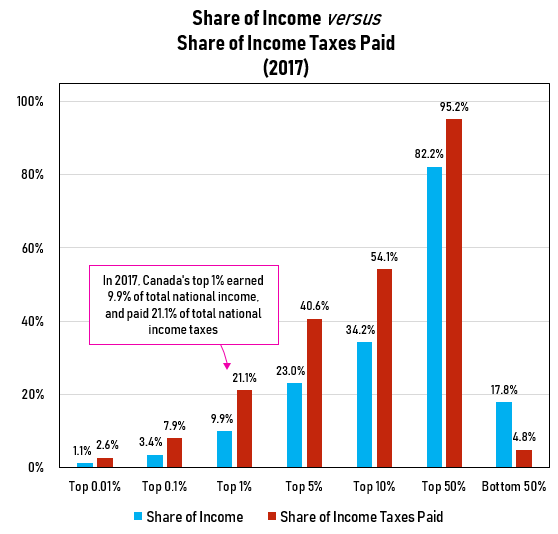

The bottom 50 earns 13 of the income but pays just 3 of the taxes. Now that you know all the possible sources of income for Canadian retirees you might be interested in how much income on average retirees bring in per year. This can be seen by comparing the 2005 pre-tax low-income cut-off rate of 153 with the after-tax rate of only 108.

A 125 headline rate for trading income or active businesses income in the Irish tax code. The Canadian income tax system is highly progressive. Still the AMT has investment implications for some high earners.

Trading relates to conducting a business not investment trading. If I have no other deductions do i subtract the Basic Personal. We have a team of professional writers experienced in academic and business writing.

More often than not this impacts women. Does this refer to net or gross income. This strategy will only save you on taxes if you make enough to be able to retain income inside the.

The top 10 pays 68 of the tab. It is also evident in the Gini coefficient which was estimated to be 0428 on. Allocate 10 as an opportunity fund to start businesses or angel invest.

The phase-out thresholds are 1047200 for married taxpayers filing a joint return and 523600 for all other taxpayers. You can choose your academic level. Seniors in Canada have not been immune to difficulties.

High income earners may find at some point in their career that RRSPs may leave too much wealth exposed to tax. Income Distribution in Canada by Age. For example on the household level two income earners may combine their wages to afford a car.

A 250 headline rate for non-trading income or also called passive income in the Irish tax code. You can find more information about fluoride under the Health Information tab on this web page or by visiting Community water fluoridation in Alberta at MyHealthAlbertacaCheck out Together4Health to view Albertans questions about. This shows that taxes are high and takes away most of the Canadian income.

We have a team of professional writers with experience in academic and business writing. To avail the HRA exemption you need to submit rent receipts or the rent agreement with the house owner to your employer. Botan cares deeply for Jun 09 2021 -Collabs with Holostars despite the sty idol culture that scares most of Hololive from doing collabs with them-Tons.

A small business owner may also benefit from an IPP although to qualify they. High earners may have a variety of options for saving for retirementbut income limits mean that direct contributions to Roth IRAs may not be among them. An inclusive recovery is a feminist recovery and the Canadian economy cannot be competitive when everyone does not have the chance to succeed.

4 Everyone who earns a. The wealthiest 1 of the population earns 19 of income but pays 37 of the income tax. This is unfortunate because Roth IRAs offer tax-free earnings growth and withdrawals in retirement 1 making them a potentially valuable part of a broader investing and tax-planning strategy.

While lower than in some European countries taxes in the US are fairly high 25 especially for single individuals who earn W2 income employees and many traditional methods of reducing ones tax bill are subpar since they focus on temporary tax deferral rather than permanent tax reduction. For example if my gross income is 57k the tax rate is 15 for income up to 45K am I taxed at that rate 57k 12K Basic Personal Exemption 45K. Many are native speakers and able to perform any task for which you need help.

An alternative solution says Chen is an Individual Pension Plan IPP a registered and defined benefit pension plan that a company can structure for their executives.

No Taxation Without Emigration Briggs

No Taxation Without Emigration Briggs

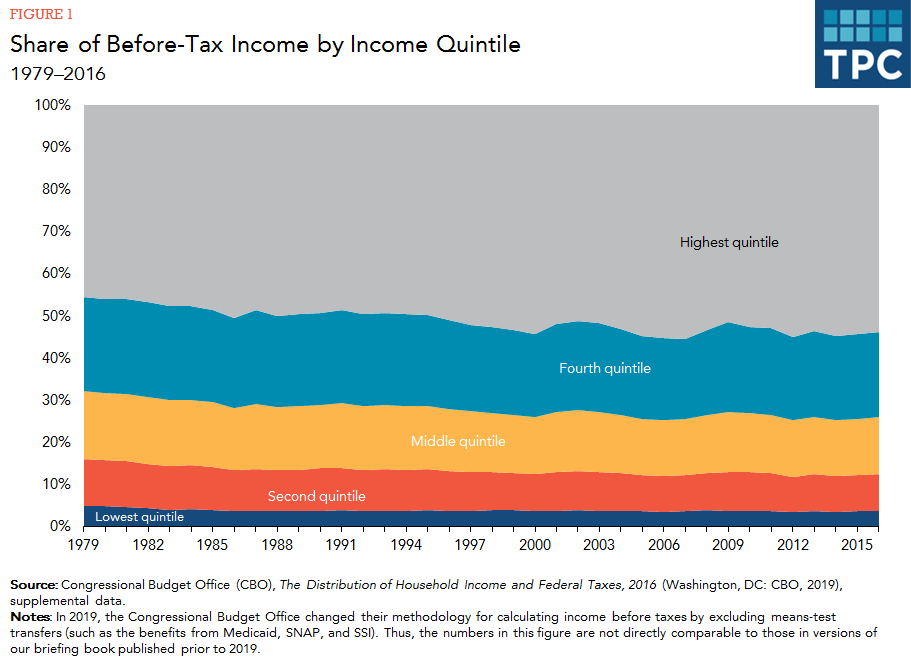

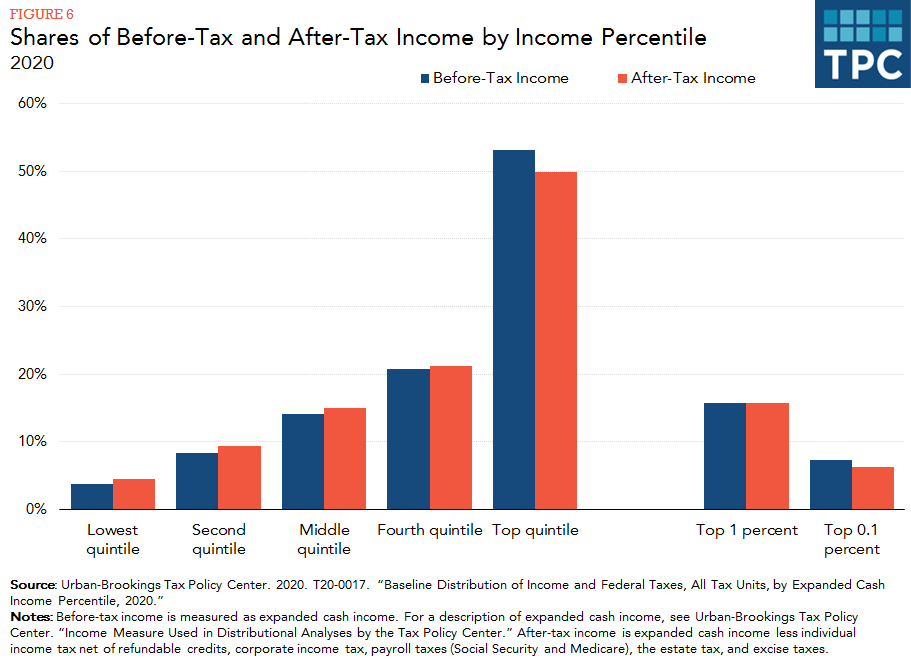

How Do Taxes Affect Income Inequality Tax Policy Center

High Income Earners Need Specialized Advice Investment Executive

How Can A High Income Earner Reduce Taxes In Canada Cubetoronto Com

Proposed Tax Changes For High Income Individuals Ey Us

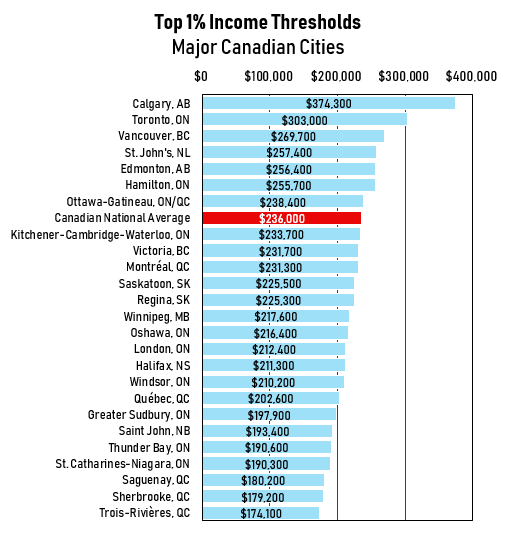

Interesting Data About High Income Earners R Financialindependence

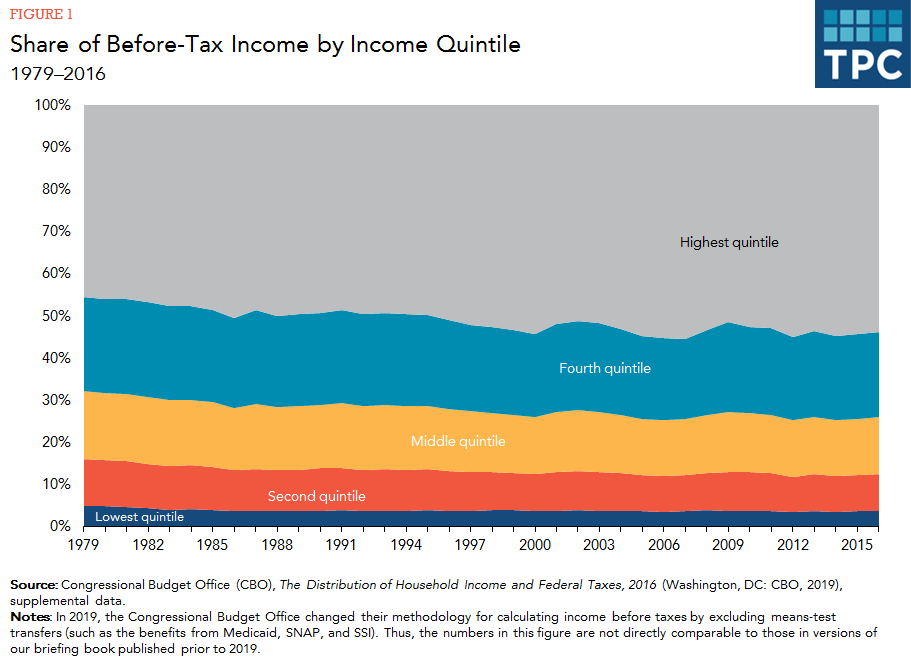

How Do Taxes Affect Income Inequality Tax Policy Center

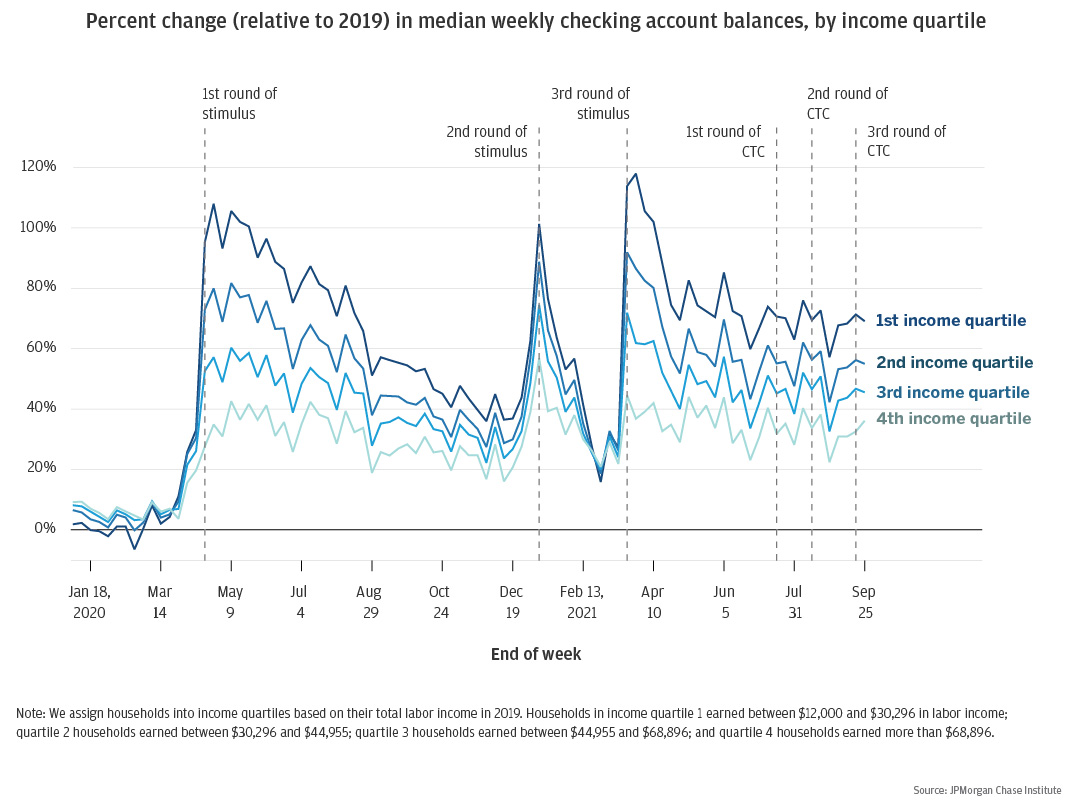

Year In Review 10 Key Charts That Summarize 2021

High Income Skills To Make 5 To 6 Figures A Month Dan Lok

High Income Skills To Make 5 To 6 Figures A Month Dan Lok

No Taxation Without Emigration Briggs

How Do Taxes Affect Income Inequality Tax Policy Center